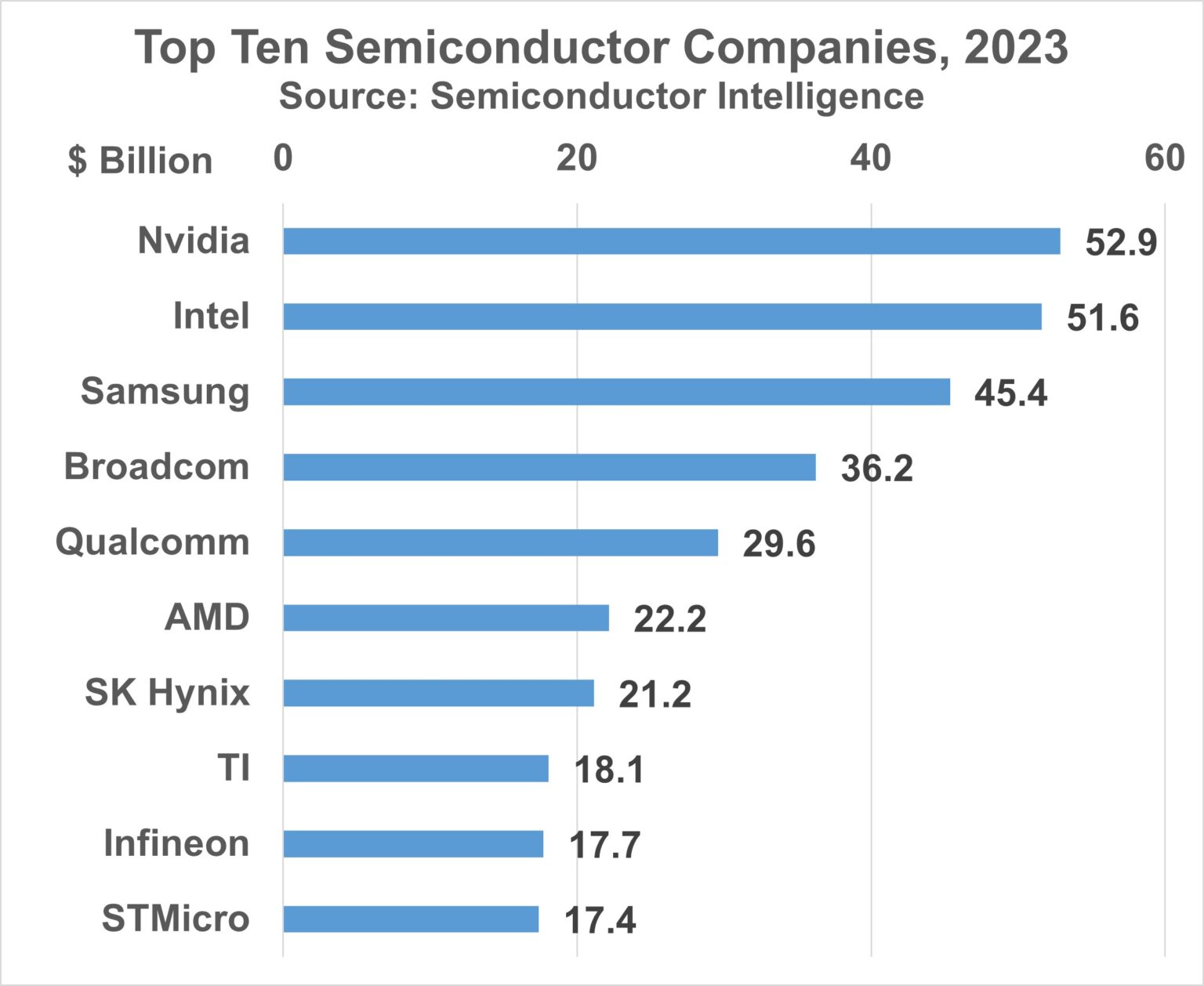

Nvidia may become the world's largest semiconductor company in 2023, with revenue of approximately $52.9 billion

With its AI processor strength, Nvidia's revenue in 2023 will be nearly twice that of 2022.

Semiconductor Intelligence has stated that Nvidia may become the highest revenue semiconductor company this year. The agency expects Nvidia's revenue to be approximately $52.9 billion in 2023, while Intel's revenue is $51.6 billion.

Semiconductor Intelligence has stated that Nvidia may become the highest revenue semiconductor company this year. The agency expects Nvidia's revenue to be approximately $52.9 billion in 2023, while Intel's revenue is $51.6 billion.

According to foreign media reports, Intel has been the number one semiconductor company for most of the past 21 years - except for Samsung, which ranked first in 2017, 2018, and 2021. Despite the rapid development of the semiconductor industry and the abundance of startup companies, the top ten companies in 2023 have been operating for at least 30 years.

NVIDIA is one of the youngest companies with only 30 years of history. The fourth ranked Botong company is the result of Avago Technologies' acquisition of Botong in 2015. However, the original Botong was established 32 years ago. Avago Technologies is a company spun off from HP, which entered the semiconductor industry 52 years ago.

Qualcomm, with a 38 year history, has grown to fifth place mainly through mobile IC and licensing revenue, but the ranking only includes Qualcomm's IC revenue. The 10th ranked Italian French semiconductor company was established in 1987 by the merger of SGS Microelettronica from Italy and Thomson Semiconductor from France. Both SGS and Thomson's semiconductor business can be traced back to the 1970s.

Two of the top ten companies are industry pioneers 70 years ago. Texas Instruments (TI) was founded in 1930 and entered the semiconductor industry in 1954. Infineon Technology was originally part of Siemens AG, founded in 1847. Siemens began producing semiconductors in 1953, while Infineon was spun off as an independent company in 1999.

Samsung Electronics and SK Hynix, two Korean companies, have over 40 years of semiconductor sales experience. After American and Japanese companies (excluding Micron Technology) largely abandoned their memory business, they dominated the industry. SK Hynix's predecessor was modern electronics, which began producing semiconductors in 1983. Hyundai merged with LG Semiconductor in 1999 to establish Hynix, later known as SK Hynix.

Intel was founded 55 years ago and initially sold storage devices. AMD began producing logic chips 54 years ago. Nowadays, these two companies mainly sell microprocessors, accounting for over 95% of the computer microprocessor market in total.

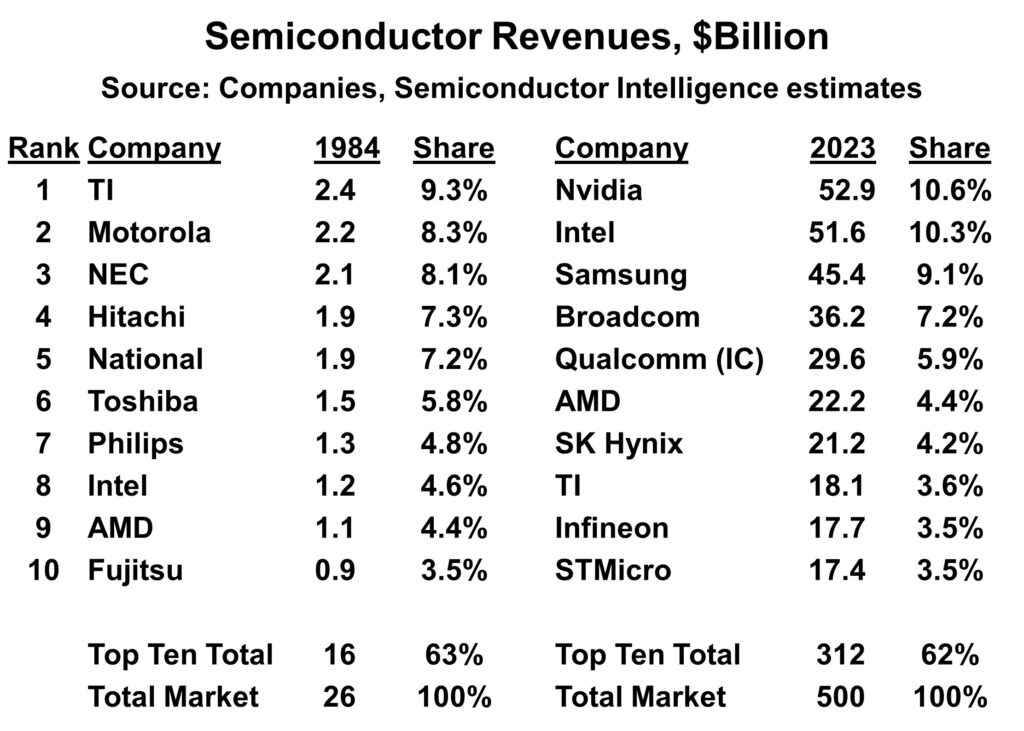

By comparing the top 10 companies in 2023 with 1984 39 years ago and the year when semiconductor intelligence leaders began conducting semiconductor market analysis, we can see the relative stability of top semiconductor companies.

Most of the top ten semiconductor companies in 1984 still operate in similar or other forms today. In 1984, Texas Instruments ranked first, but since then it has narrowed its business scope and become a major analog equipment company.

Motorola, ranked second, split its discrete device business into Ansemy Semiconductor in 1999. Ansemy is now a company with a market value of $8 billion and acquired industry pioneer Xiantong Semiconductor in 2016. Motorola split its IC business into Freescale Semiconductor in 2004.

In 2006, NXP Semiconductor Company was spun off from Philips, ranked seventh, and merged with Freescale in 12015. Enzhipu is currently a company with a market value of $13 billion. National Semiconductor, ranked fifth, was acquired by Texas Instruments in 2011. In 1984, Intel and AMD ranked seventh and eighth respectively. By 2023, they will be ranked second and sixth respectively.

NVIDIA is one of the youngest companies with only 30 years of history. The fourth ranked Botong company is the result of Avago Technologies' acquisition of Botong in 2015. However, the original Botong was established 32 years ago. Avago Technologies is a company spun off from HP, which entered the semiconductor industry 52 years ago.

Qualcomm, with a 38 year history, has grown to fifth place mainly through mobile IC and licensing revenue, but the ranking only includes Qualcomm's IC revenue. The 10th ranked Italian French semiconductor company was established in 1987 by the merger of SGS Microelettronica from Italy and Thomson Semiconductor from France. Both SGS and Thomson's semiconductor business can be traced back to the 1970s.

Two of the top ten companies are industry pioneers 70 years ago. Texas Instruments (TI) was founded in 1930 and entered the semiconductor industry in 1954. Infineon Technology was originally part of Siemens AG, founded in 1847. Siemens began producing semiconductors in 1953, while Infineon was spun off as an independent company in 1999.

Samsung Electronics and SK Hynix, two Korean companies, have over 40 years of semiconductor sales experience. After American and Japanese companies (excluding Micron Technology) largely abandoned their memory business, they dominated the industry. SK Hynix's predecessor was modern electronics, which began producing semiconductors in 1983. Hyundai merged with LG Semiconductor in 1999 to establish Hynix, later known as SK Hynix.

Intel was founded 55 years ago and initially sold storage devices. AMD began producing logic chips 54 years ago. Nowadays, these two companies mainly sell microprocessors, accounting for over 95% of the computer microprocessor market in total.

By comparing the top 10 companies in 2023 with 1984 39 years ago and the year when semiconductor intelligence leaders began conducting semiconductor market analysis, we can see the relative stability of top semiconductor companies.

Most of the top ten semiconductor companies in 1984 still operate in similar or other forms today. In 1984, Texas Instruments ranked first, but since then it has narrowed its business scope and become a major analog equipment company.

Motorola, ranked second, split its discrete device business into Ansemy Semiconductor in 1999. Ansemy is now a company with a market value of $8 billion and acquired industry pioneer Xiantong Semiconductor in 2016. Motorola split its IC business into Freescale Semiconductor in 2004.

In 2006, NXP Semiconductor Company was spun off from Philips, ranked seventh, and merged with Freescale in 12015. Enzhipu is currently a company with a market value of $13 billion. National Semiconductor, ranked fifth, was acquired by Texas Instruments in 2011. In 1984, Intel and AMD ranked seventh and eighth respectively. By 2023, they will be ranked second and sixth respectively.

For most of the 1980s and 1990s, Japanese companies performed strongly in the semiconductor industry, especially in the memory sector. They are all large, vertically integrated companies. Starting from the late 1990s, these companies began to spin off their semiconductor business.

Renesa Electronics is a merger of non storage businesses from Hitachi, Mitsubishi, and NEC. Renesa Electronics is now a company worth $13 billion. NEC and Hitachi spun off their DRAM business in 1999 and established Erbida Memory Company. Erbida was acquired by Micron Technology in 2013.

Toshiba spun off its flash memory business into Kioxia in 2016. In 2022, Kixia's revenue exceeded $11 billion. Toshiba continues to primarily provide discrete semiconductor devices.

Fujitsu spun off its IC foundry business in 2014, which was later acquired by Lianhua Electronics. Fujitsu and AMD have established a joint venture, Spansion, to produce flash memory. Spansion merged with Cypress Semiconductor in 2014, and Cypress was acquired by Infineon in 2020.

The market share of the top ten companies in 1984 and 2023 proves the relative stability of the semiconductor industry. In 1984, Texas Instruments had a market share of 9.3%. By 2023, NVIDIA's market share will reach around 10.6%. In 1984, the total market share of the top ten companies was 63%. By 2023, this proportion will reach around 62%. Although top companies are relatively stable, the industry's sales have increased from $26 billion in 1984 to $500 billion in 2023, almost a 20-fold increase.

Renesa Electronics is a merger of non storage businesses from Hitachi, Mitsubishi, and NEC. Renesa Electronics is now a company worth $13 billion. NEC and Hitachi spun off their DRAM business in 1999 and established Erbida Memory Company. Erbida was acquired by Micron Technology in 2013.

Toshiba spun off its flash memory business into Kioxia in 2016. In 2022, Kixia's revenue exceeded $11 billion. Toshiba continues to primarily provide discrete semiconductor devices.

Fujitsu spun off its IC foundry business in 2014, which was later acquired by Lianhua Electronics. Fujitsu and AMD have established a joint venture, Spansion, to produce flash memory. Spansion merged with Cypress Semiconductor in 2014, and Cypress was acquired by Infineon in 2020.

The market share of the top ten companies in 1984 and 2023 proves the relative stability of the semiconductor industry. In 1984, Texas Instruments had a market share of 9.3%. By 2023, NVIDIA's market share will reach around 10.6%. In 1984, the total market share of the top ten companies was 63%. By 2023, this proportion will reach around 62%. Although top companies are relatively stable, the industry's sales have increased from $26 billion in 1984 to $500 billion in 2023, almost a 20-fold increase.